Dear Fellow Property Investor,

With property prices reaching record highs across the country, the humble home has become the main breadwinner in many households. In certain suburbs, homes are earning multiple times the average wage.

National property prices hit new record highs in February, up 6.15% compared to a year ago, the fastest annual rise since July 2022, according to PropTrack.

For hundreds of thousands of Australians, that growth means their homes may have generated more income than their own salaries over the past year.

New analysis has used PropTrack's automation valuation model (AVM) to reveal the suburbs around the country where the median property price has grown by more than the average Australian wage.

According to ABS data released in February, the gross weekly ordinary time earnings for full-time adults was $1,888.80 in November 2023, which translates to average annual earnings of $98,218. Given the family home is exempt from the capital gains tax, an increase in value stretches even further than the average annual wage on a dollar-for-dollar basis.

Almost 900 suburbs around the country saw their median property price grow by more than $98,218 in the year to February.

The suburbs that saw the steepest hikes in value were the premium pockets in capital cities, which is unsurprising according to PropTrack senior economist Paul Ryan.

"In exclusive suburbs the same percentage increase will lead to a larger increase in terms of dollar value. And remember too, some of those premium suburbs saw quite sharp reductions in prices in 2022 so this is prices snapping back."

But solid price growth also happened in more affordable areas, Mr Ryan added.

"Over the past year or so, we've seen even and consistent growth within cities. While we're still seeing strong demand and strong growth in premium suburbs, this is happening in more affordable suburbs too."

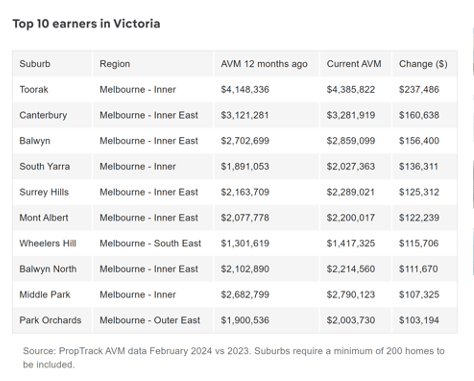

Melbourne property prices grew by a relatively modest 1.33% over the year, but in the exclusive inner-Melbourne suburbs of Toorak and South Yarra, houses gained $237,486 and $136,311 respectively.

Here are the suburbs in Melbourne where properties have earned the most this past year:

Let me ask you something…

Do you have a game plan for 2024?

Or will you watch savvy, educated, market-ready investors snap up all the bargains at the bottom of the Melbourne property cycle (which, in my opinion, already bottomed out in November 2022), again?

Or, will you join them?

So, what are you waiting for?

Reserve your place and join me and 55 like-minded property investors for the first Real Estate Investing Fast Track Weekend for 2024!

Click HERE to reserve your seat now!